What is OPC

One Person Company is a most recent child in the Incorporation Family, which was introduced by the Companies Act, 2013. This is the first time in India to enables one single member to get a company Incorporated through ROC. Previous to this a single member can only form a Proprietorship form. Now after this act, the proprietor can for a OPC where he does not need another person as a Co-Director; where usually he will get his wife or mother as the co-director by allocating 0.01% Share.

Some Facts about OPC

Only One Member

No Minimum capital

Residence address*

OPC is appropriate for small businesses where the annual income is not more than two Crore. The main constraint of OPC form of company is that only an Indian Citizen can incorporate an OPC Company and Foreign Direct Investment is not allowed in OPC. Further you cannot incorporate more than one OPC or nominate as director for more than one OPC.

Taxation

There is no difference between a Private limited and OPC as realting to Taxation. The tax rate is flat 30% as applicable for any Company incorporated under Indian Companies Act.

Voluntary conversion of OPC to Private Limited

Once the OPC is incorporated, you cannot voluntarily convert an OPC to Private Limited or Public limited within a period of two years.

On completion of two years, an OPC can be converted to Public Limited or Private Limited on requisition by the BOD.

But if the turnover of the OPC exceeds 50 Lakhs, immediately preceding three financial years exceeds two crore, then the OPC has to be mandatorily convert to Private limited or Public limited Company.

Reason behind introduction of OPC

- Before introducing OPC, only two person minimum can form a Company

- So the promoter stared inducting his wife or mother to form a company which is just for name sake.

- A proprietor who is a simple person is unable to form his own Company

- As Pvt Ltd needs minimum 2 directors, nominee directors are stared been appointed, so to avoid these fraudulent activity, the process of incorporation has been totally amended.

- Hence for the above reason the amendment is the companies act is brought for incorporating a company with one director

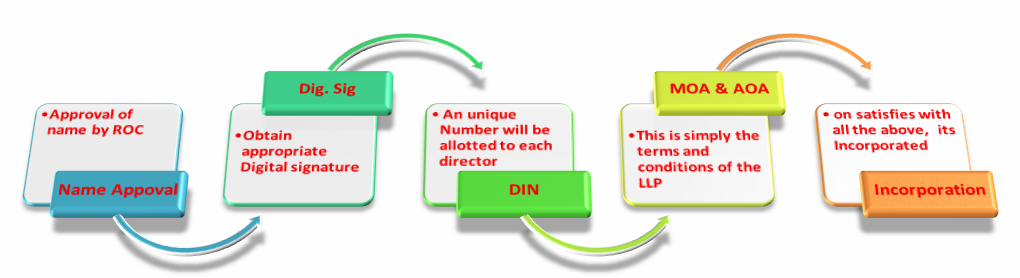

Procedure for incorporating OPC

Mandatory Compliances for OPC

- One Board of Directors meeting at least once in six months

- Maintain a proper book of accounts

- Statutory audit of financial statement

- Filing of income tax for company

Trademark Registration

Easy Steps to Register

Copyright Registration

Easy Steps to Register

Company Registration

Easy Steps to Register

Design Registration

Easy Steps to Register

Patent Registration

Easy Steps to Register

MSME Registration

Easy Steps to Register